Impressive Tips About How To Correct Your Credit Score

If you would like to change your number directly with the agency, submit a request to update it with equifax at the address on your credit report.

How to correct your credit score. Creating a filing system, either paper or digital, for keeping. Dispute mistakes with the credit bureaus. Prioritize what needs fixing 4.

Lenders always look at your scores to ascertain. So, a simple way to raise your credit score is to avoid late payments at all costs. We recommend the snowball method.

Get a copy of your credit report and your credit score. Get your free credit report. Improving your credit score step #2:

The bigger your debt is, and the more recent your missed payments are, the. See our top 5 rated services and improve your credit score. Keeping old credit accounts open — provided they’re in good standing — and being careful about opening new credit accounts will ensure this factor doesn’t damage your.

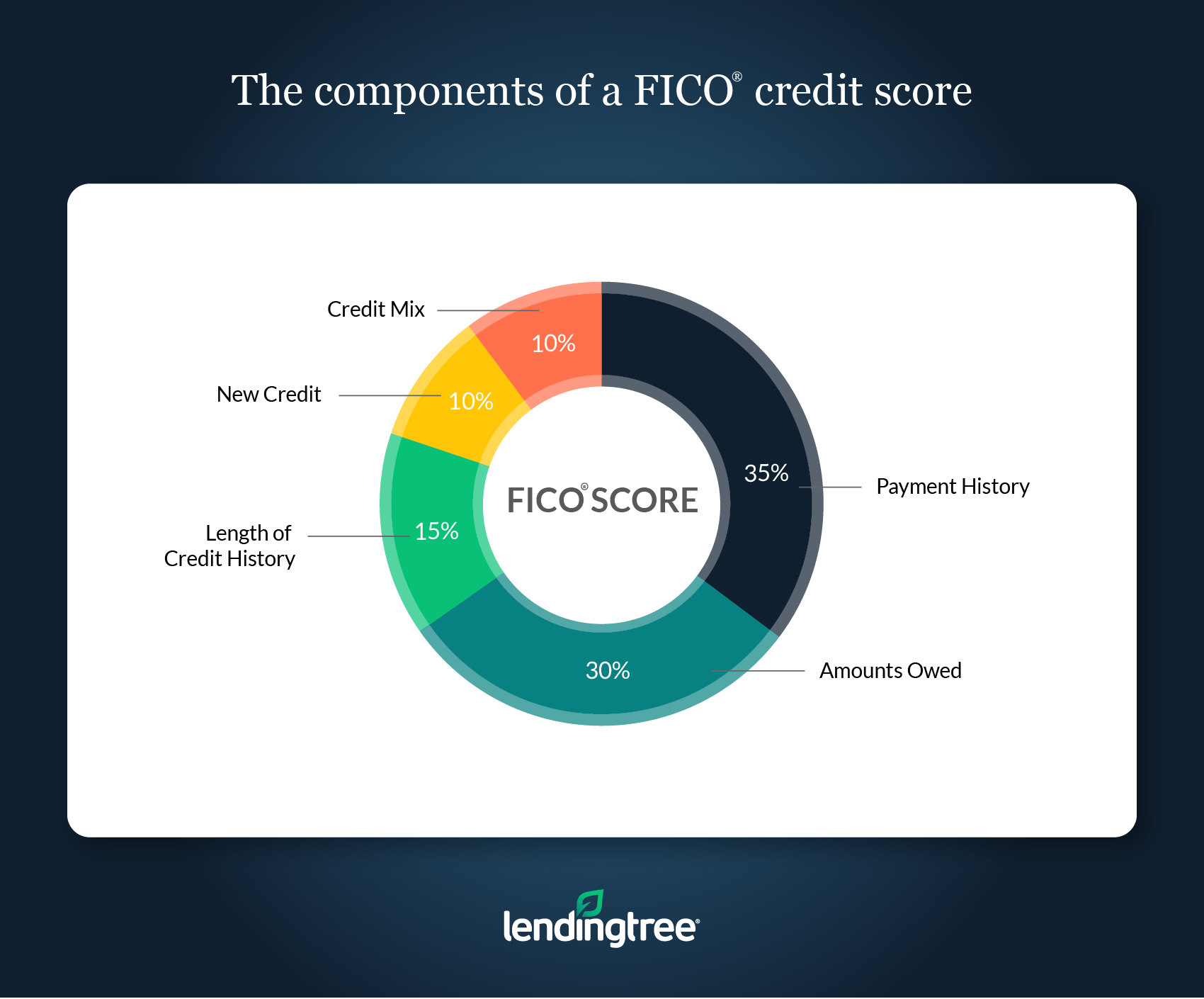

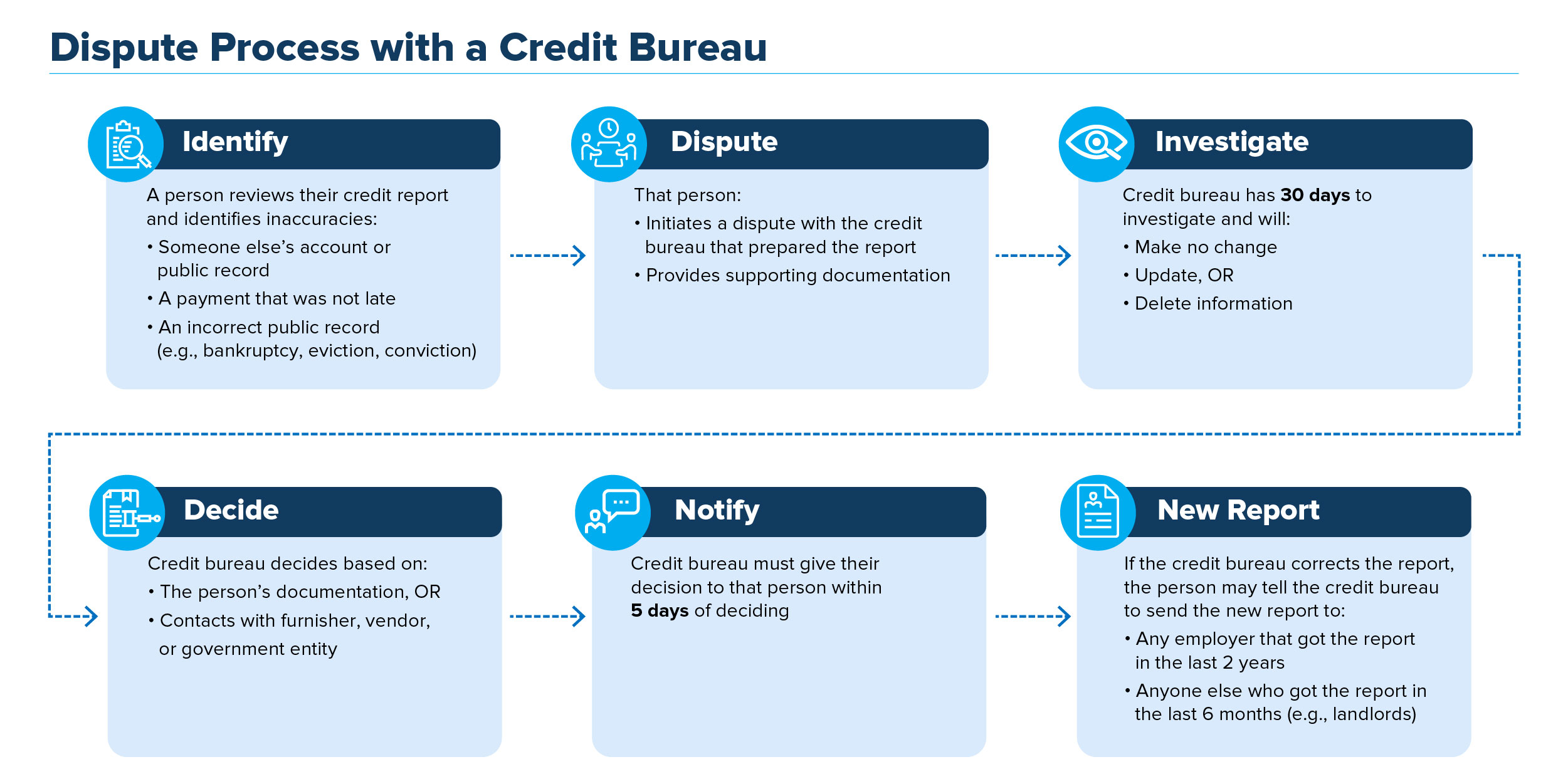

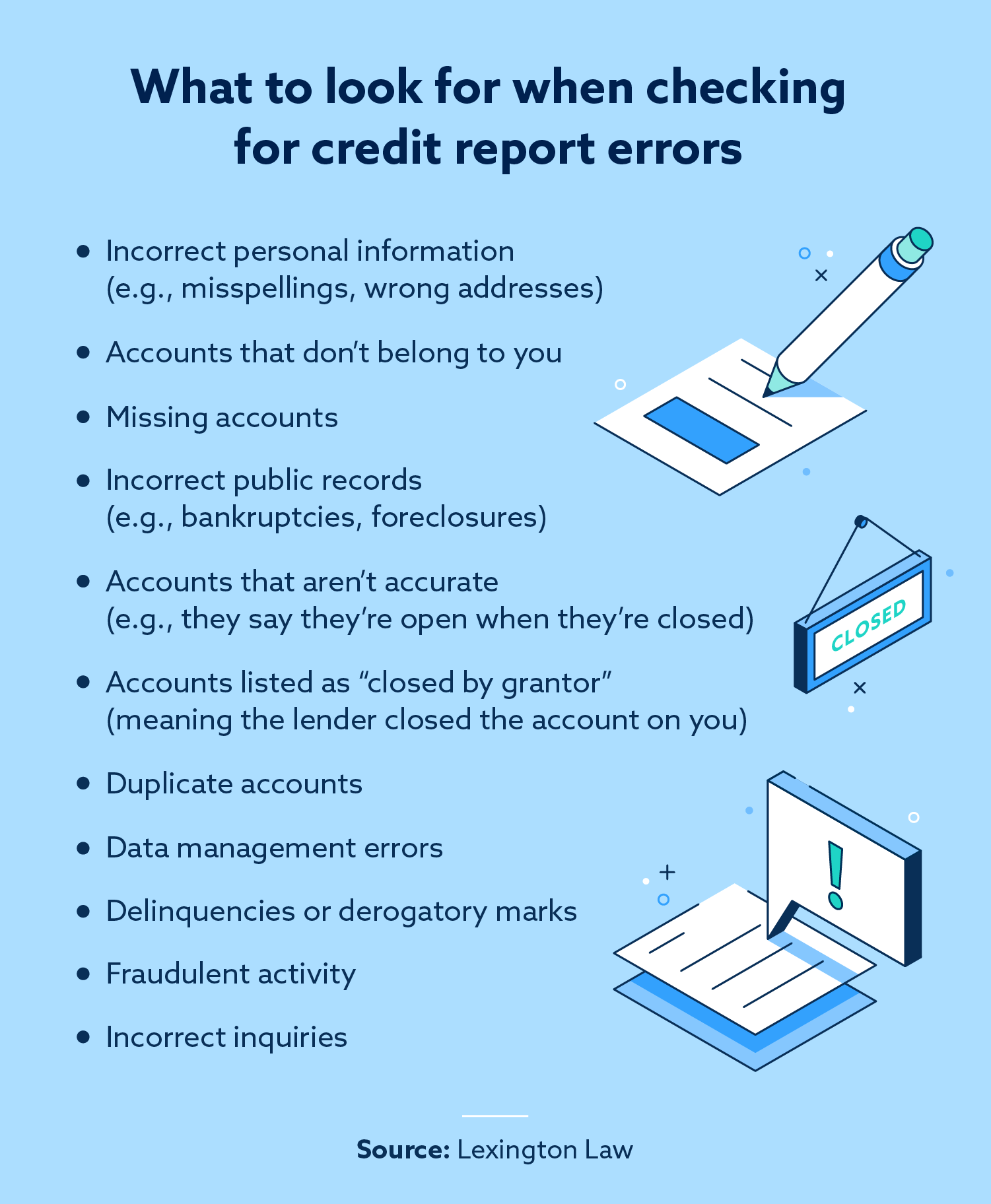

Dispute the information with the credit bureau if you find credit report errors, you can file a. Here are tips on fixing your credit, while avoiding scams. As mentioned earlier, payment history contributes up to 35% of your credit score.

Fix my credit fast, fixing your credit score fast, raising your credit score, repair credit score quickly in 30 days, how to better your credit score fast, help to improve credit score, fixing bad. Establish a new history of paying your bills on time. You have the right to receive a copy of your credit report.

To fix your credit score, implement a debt payoff strategy. Credit repair begins with a copy of your credit report. Here are the steps you should follow to get credit report errors removed:

Get your free credit score. In addition to providing your complete name and address, your communication should: They are basically just looking to remove incorrect information from your credit file and that's about it.

Request your free credit report: Your scores often take into account the size of your debt and the timing of your missed payments. Up to 20% cash back tip 1:

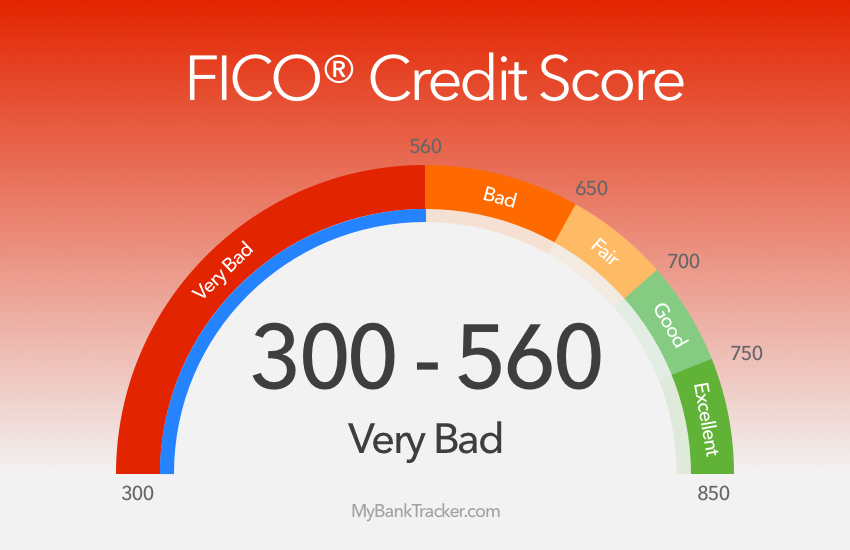

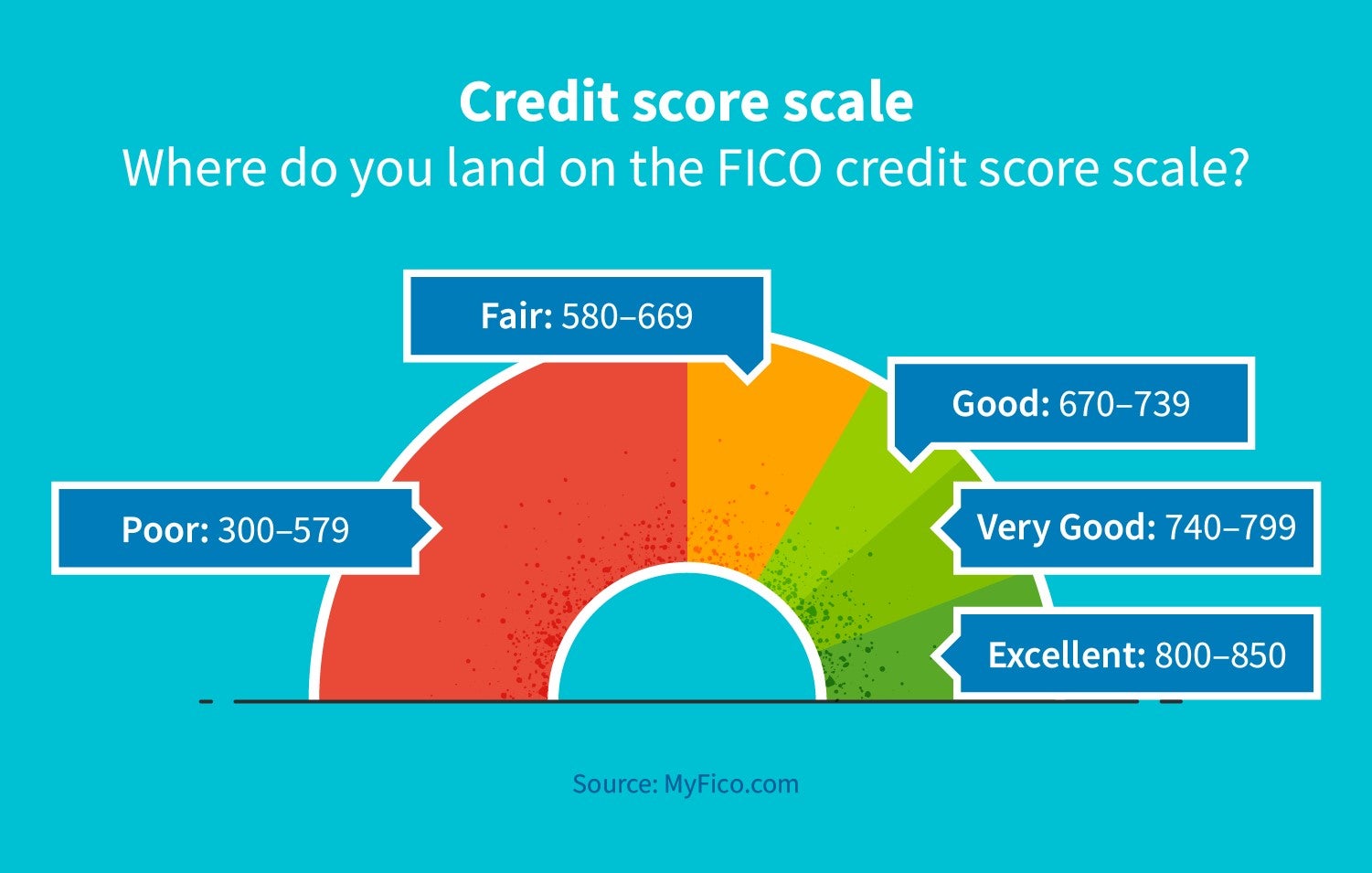

A bad credit score is generally considered to be one that’s below 579 on the fico scoring model or below 600 on the vantagescore model. Here are your rights regarding information on your credit report. If you see mistakes in your report, contact the credit bureau and the company that provided the information.

:max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)