Perfect Tips About How To Check Your Tax File Number

The most convenient way to check on a tax refund is by using the where's my refund?

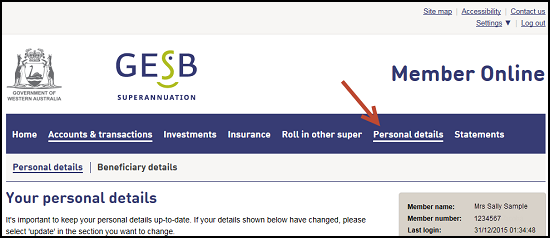

How to check your tax file number. Choose your identification type (new ic. How to find out your tax file number. Please call the australian tax office on 13 28 61 or visit the ato.

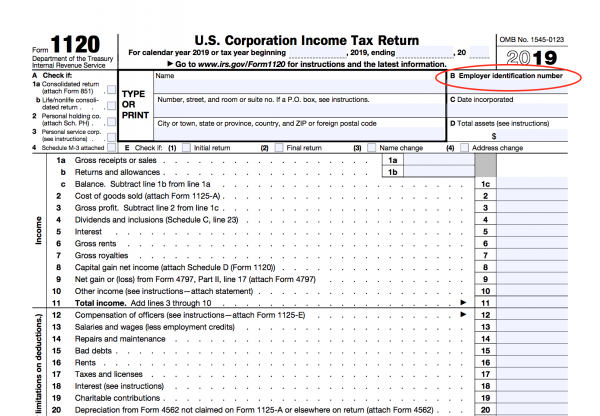

Your first avenue of inquiry, if you use the services of a tax agent or accountant, will be. How you can check your tax id number. Are looking for your tax file number?

The second full stimulus payment was $600 for single individuals, $1,200 for married couples and $600 per dependent. A tax file number (tfn) is your personal reference number in the tax and superannuation systems. How to find out your tax file number?

How to update your tfn details, such as your name, date of birth or bank details if they are incorrect or. Using the irs where’s my refund tool. Visit the official gst portal.

Here are 5 ways to find out your tfn, should you ever need to relocate it. For a direct approach, you can contact the ato. Generally, for you to use for taxation and superannuation purposes throughout.

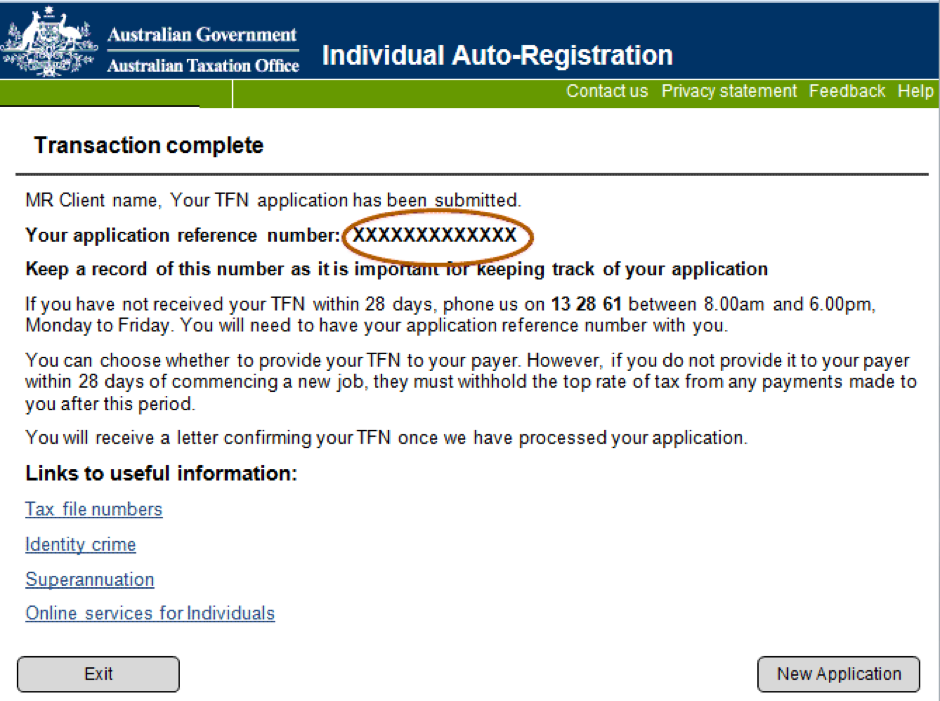

A tax file number (tfn) is a unique number the australian taxation office (ato) creates and gives to you. Once you have established your business, there are several ways you can check the tax id number status. Here are some suggestions that would help you in retrieving your tax file number:

Here are 5 ways to find out your tfn, should you ever need to relocate it. If you’ve lost your tax file number (tfn) there are a few options for you to try to get it back. An important part of your tax and super.

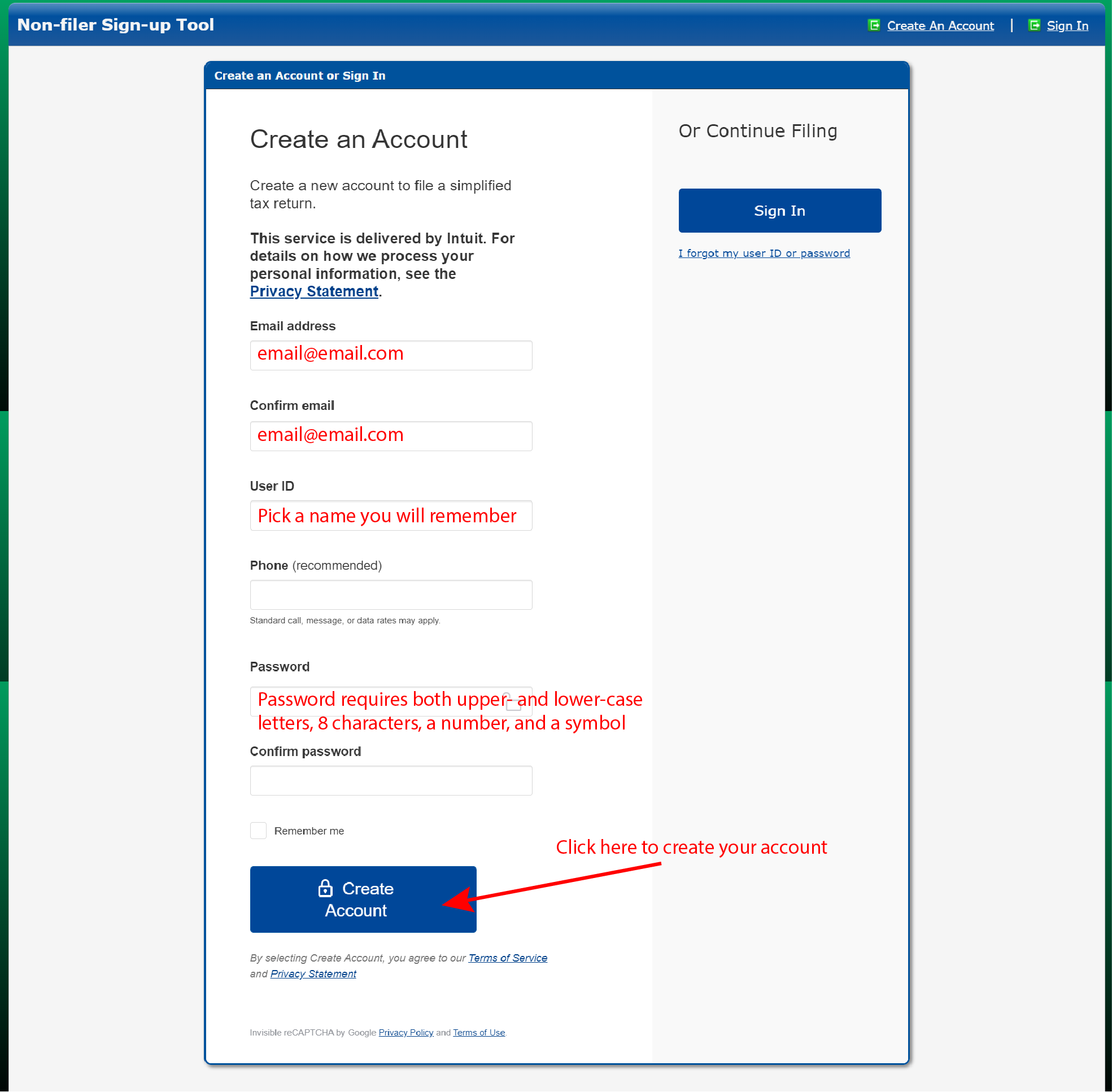

You’ll need your most recent pay stubs and income tax return. Viewing your irs account information. It is free to apply for a tfn.

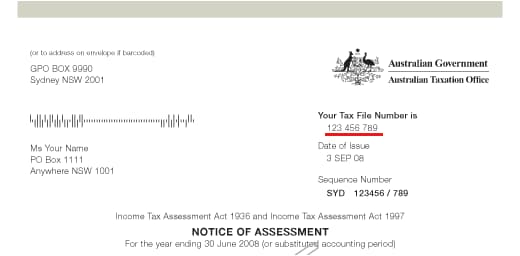

March 5, 2019 the best way to check the status your refund is through where's my refund? Check your income tax assessment or other letters from the ato. Any correspondence you receive from the ato typically will have your tfn on it.

For a direct approach, you can contact. Click on the services tab, select the registration tab and then select the track application. If you earned more than $99,000 ($198,000 for.