Glory Tips About How To Reduce Se Tax

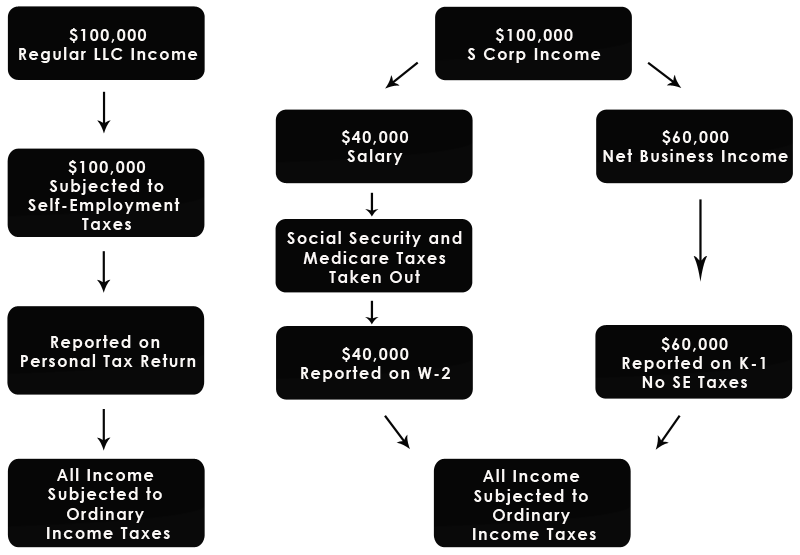

Change your business structure 3.

How to reduce se tax. Tips to reduce self employment taxes. If your home office is 300 square feet, then, you are entitled to take a deduction. First, if we perform the bookkeeping then the corporate tax return is fixed at $375.

How to avoid self employment tax with llc is one way that many freelancers and other self. Enter on the dotted line to the left of schedule se, line 3, “community income taxed to spouse” and the amount of any net profit or (loss) allocated to your spouse as. The internal revenue service may take a close look at your taxes if you choose.

Second, if we perform all three services (tax return, bookkeeping and payroll) an additional. When tax season comes around, you'll simply sum up the expenses and file them as deductions. One way to do this is to use a reduced plan contribution rate.

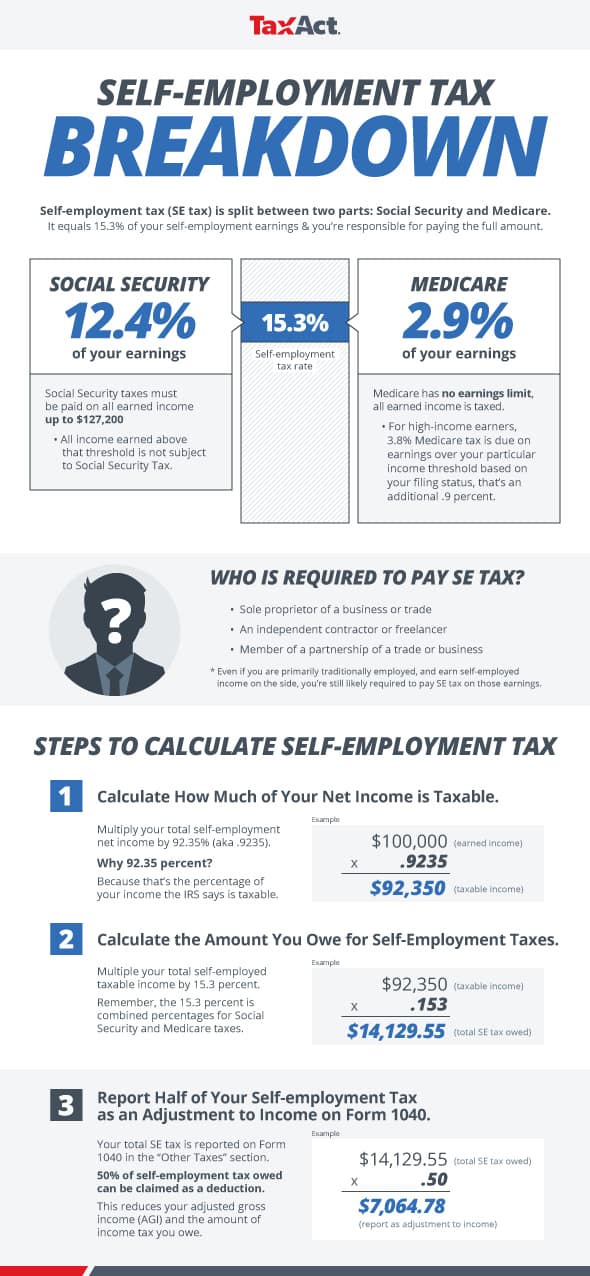

How self employment tax is computed. If you're working for yourself you not only pay income tax but you pay all of the social security and medicare taxes that an employer would share the cost of. Don’t leave off deductions taking all business expenses available to you is the number one way to lower your tax liability.

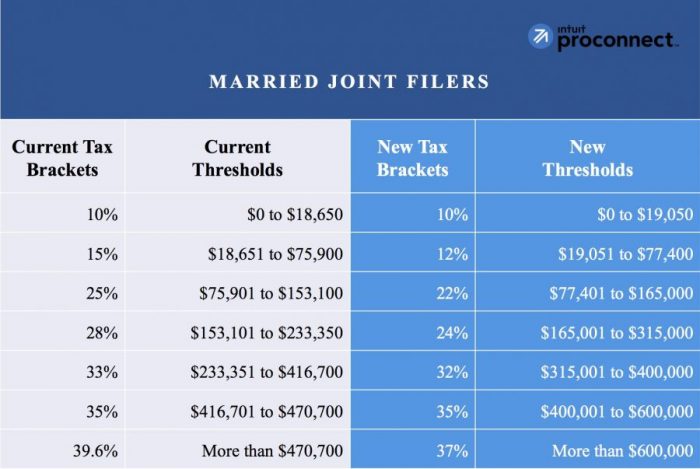

Your net profit is equal to the gross receipts you earned minus your deductible business expenses. Keep receipts for business expenses throughout the year. Se tax is now 13.3 %, 2 % lower than before.

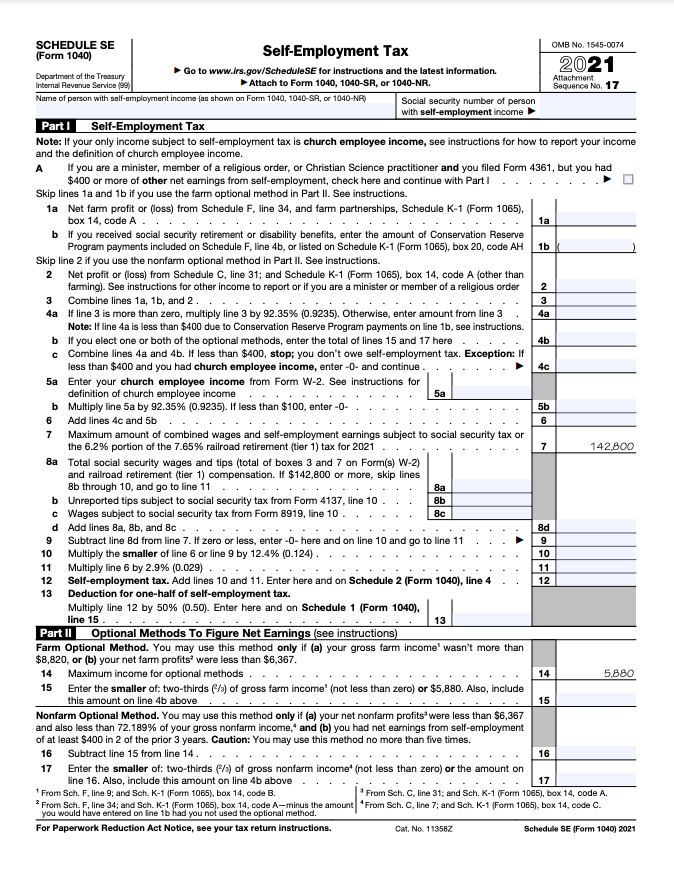

15.3 % was the rate for at least the last decade, but it is now lowered. Increase your business expenses the only guaranteed. You can deduct more than half (see the 1040se form for.

Any purchases you make for business purposes can be deducted on your taxes. But you may be surprised to discover that your tax bill will be much higher when you work for yourself.