The Secret Of Info About How To Get A Better Credit Score

If your credit score is closer to 1000, it means that.

How to get a better credit score. How to improve credit fast 1. The portion of your credit limits you're using at any given time is called. 21 hours agopersonal credit report disputes cannot be submitted through ask experian.

Serving over 1 million customers worldwide. Here are our top choices for the best services for removing collections from a credit report: Building a great credit score takes time.

Get started with 7 day free trial. 4.1/5 ( 3 votes ) it's best to apply for a credit card about once per year, assuming you need or want a card in the first place. Use a credit card little and often.

Use around 30% of your credit limit, if possible. You don’t need to revolve on credit cards to get a good score. You can grow your score by using credit regularly and responsibly.

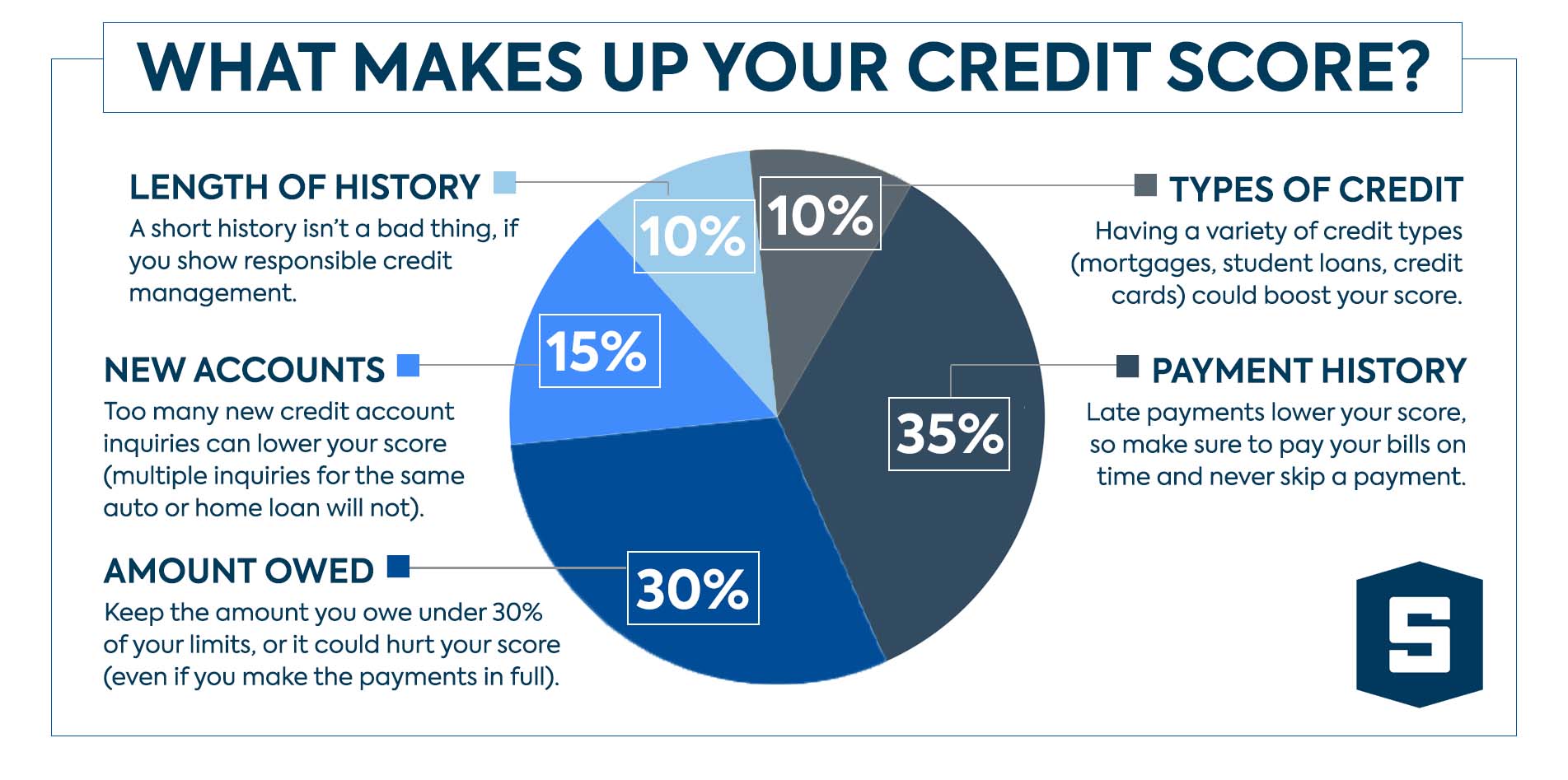

Therefore, the next important step to take to improve your. The amount of debt you have is a major factor influencing your credit score. To dispute information in your personal credit report, simply follow the instructions provided with.

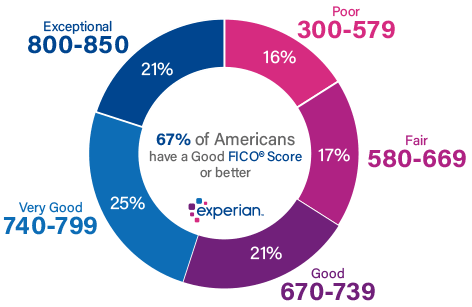

Fico score 2, 5 and 4 are the scoring models used by experian, equifax and transunion, respectively, for mortgage lending calculations. Learn 7 actionable tips to help rebuild your credit and improve your score. And you shouldn't apply for more than one.

Order your credit reports, credit scores and debt analysis online to get a comprehensive current. The fico scoring formula will penalize. A great way to quickly improve your credit score is to reduce the number of accounts that you have outstanding balances on.

Credit utilization is the next largest factor, making up 30% of your overall credit score. Experts advise keeping your use of credit at no more than 30 percent of your total credit limit. Get your credit score & equifax credit report.

Reducing your balances on your credit cards and loans is a quick. For example, if you have $5,000 in credit, try to keep less than $1,500 charged to your card. Learn how to get a better credit score by paying bills on time, keeping your credit utilization ratio low, and more.

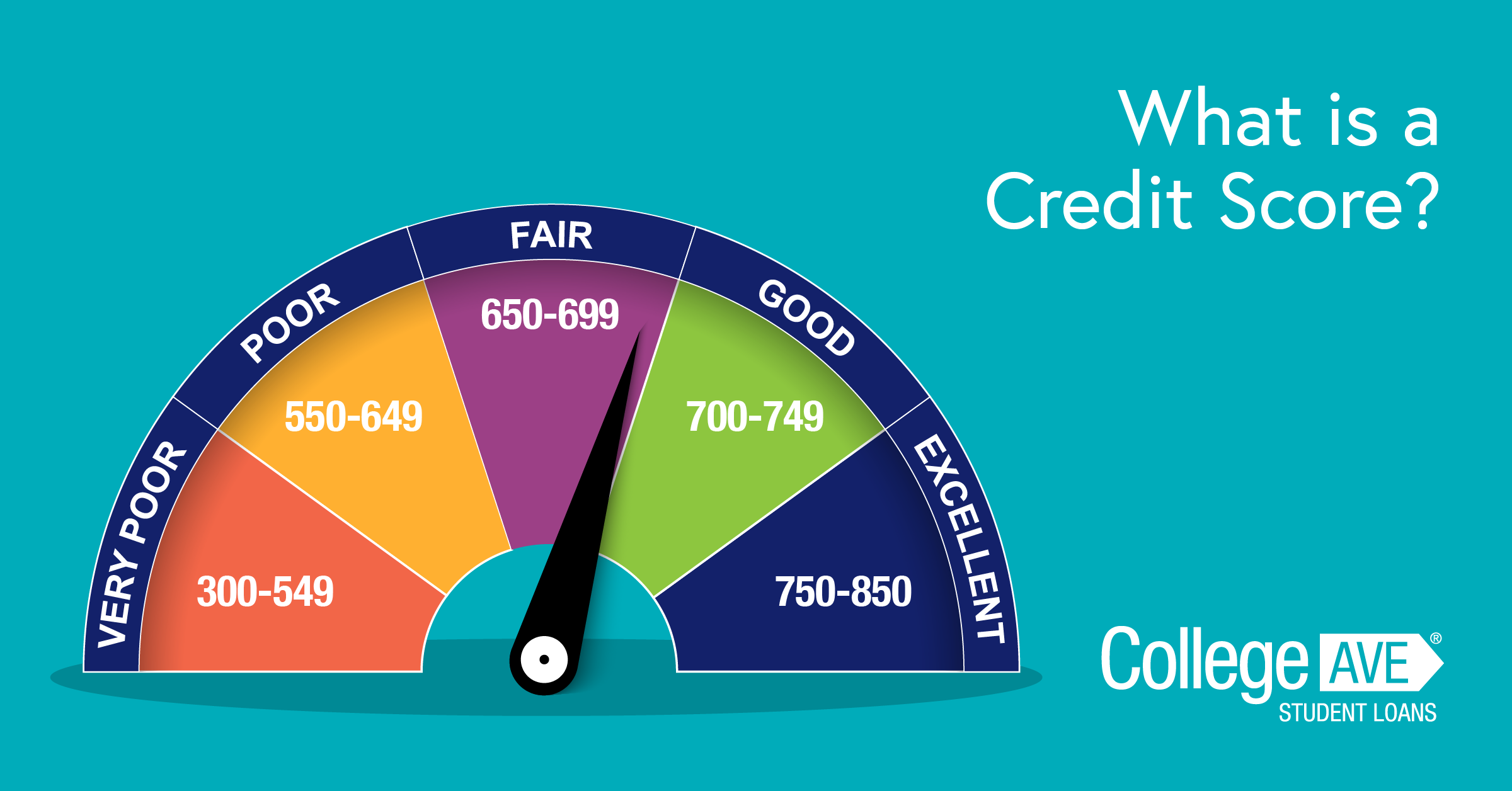

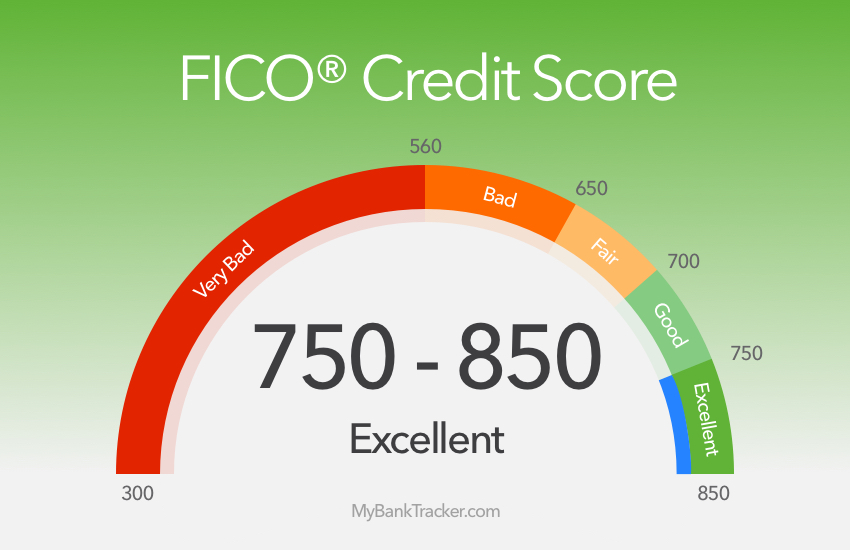

In some cases, credit repair companies may advertise fast results, but they can't do anything about your credit. Pay credit card balances strategically. For a credit score scale like this, any score above 700 is considered.