Perfect Tips About How To Apply For Family Tax Benefit

The family assistance division administers programs funded by the temporary assistance for needy families (tanf) block grant designed to provide benefits and services to needy families.

How to apply for family tax benefit. Care for the child for at least. Family tax benefit (ftb) is a. Select apply for family assistance (including paid parental leave).

Answer the eligibility check questions first. End your irs tax problems today! Compare 2022's 10 best tax relief companies.

It is made up of two parts: Myalabama help what do you need help with? The income you earn depends on your circumstance (not your partner) and does not set a limit.

Share a family contract on isu plan. Answer the eligibility check questions first. Have a family tax benefit child (ftb child) in your care.

Child and family benefits, eligibility, benefits calculator, and payment dates government benefits finder answer questions to find federal, provincial, and territorial benefits that may apply to you Alabama department of human resources. Ad save money from irs tax penalties with the best tax relief services.

Start your claim and answer the questions. To get this you must: To be eligible for family tax benefit part a, you must:

Find out about eligibility and how to claim. Select apply for family assistance (including paid parental leave). • faculty • professional & scientific • merit • pre/post doctoral associates.

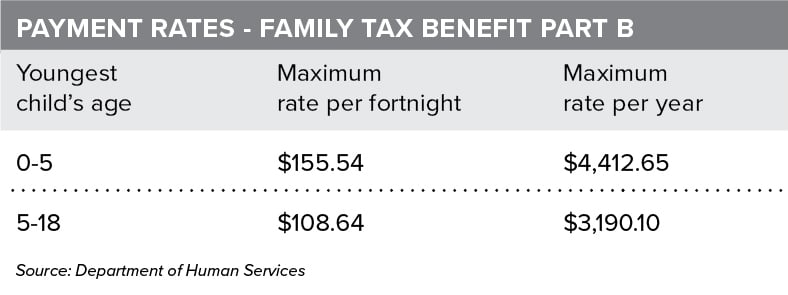

Start your claim and answer the questions about your situation. If your spouse is applying for benefits, we may also ask. The maximum benefit available will range from.

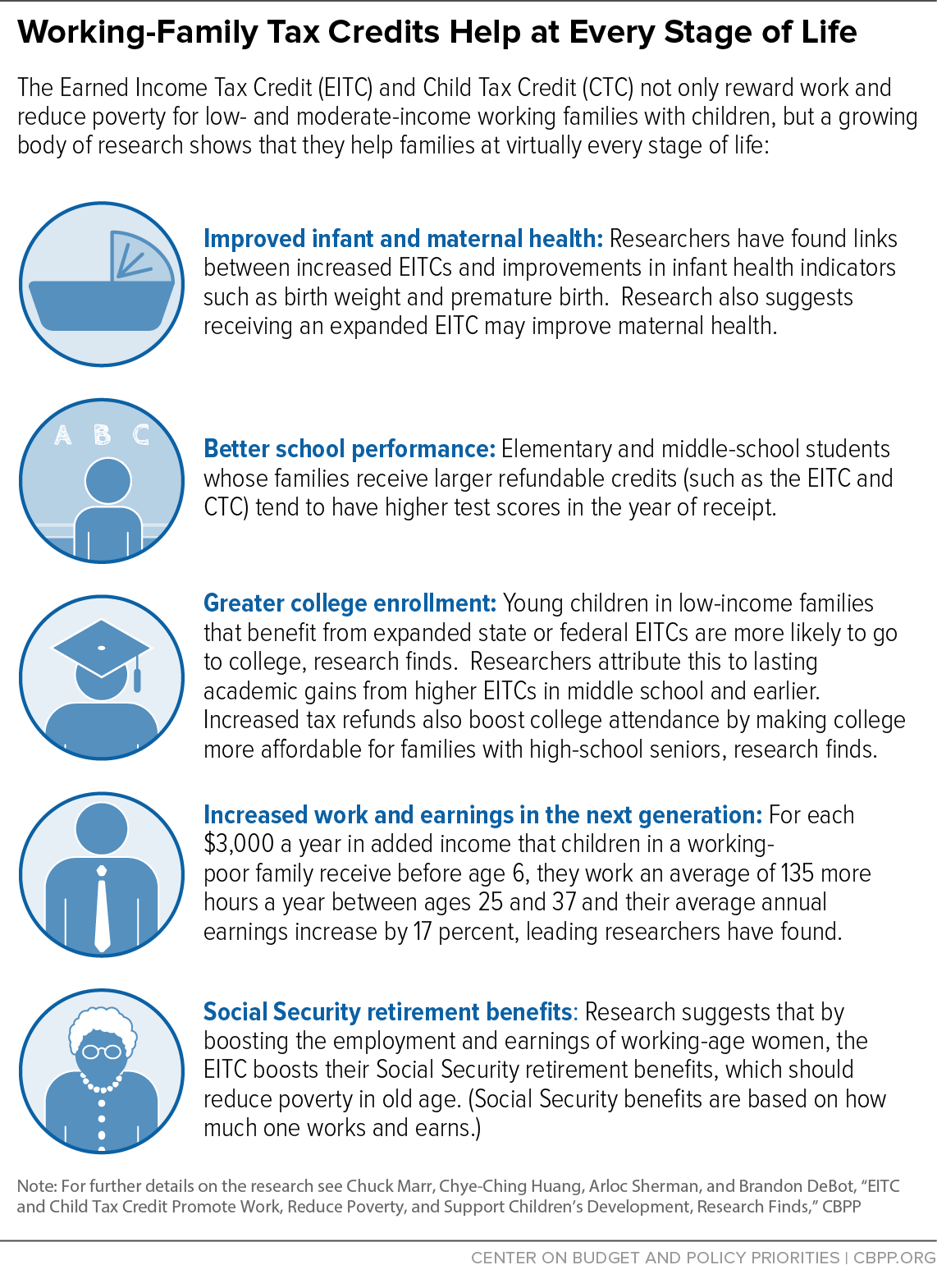

According to the census bureau, you can get 138,000 pounds for unmarried. Family tax benefit (ftb) is a payment that helps eligible families with the cost of raising children. If any of your qualified family members apply for benefits, we will ask for their social security numbers and their birth certificates.

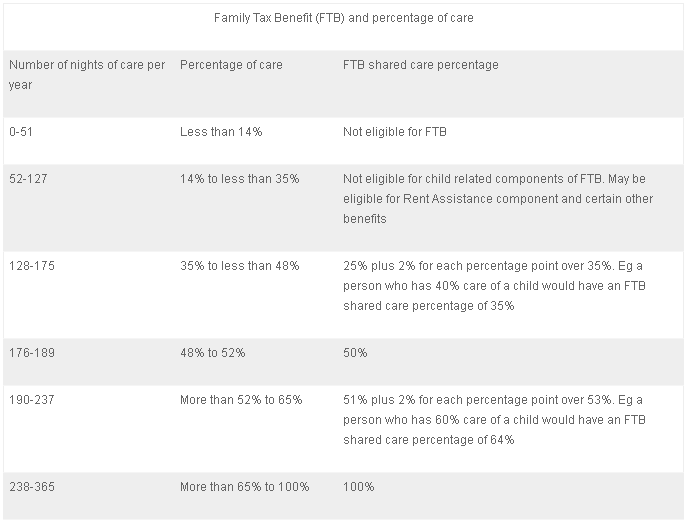

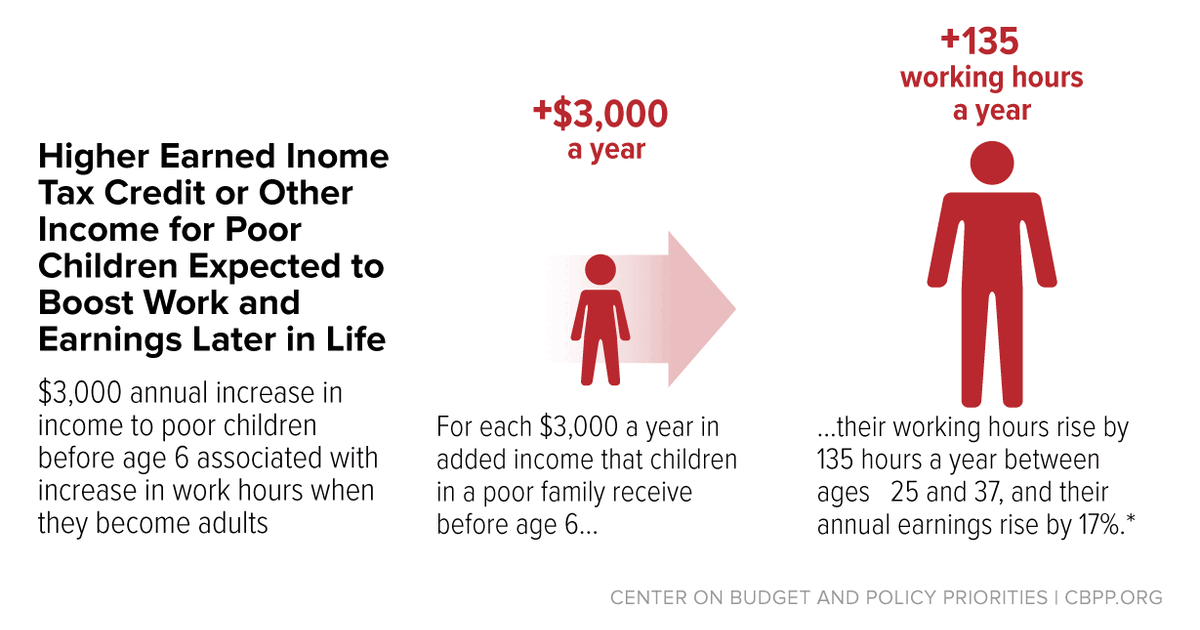

For more information, go to www.humanservices.gov.au/families The amount of the benefit is dependent on a family’s employment income, net income and number of children in the family. What are the rates for the family tax benefit part a and family tax benefit part b in 2022?